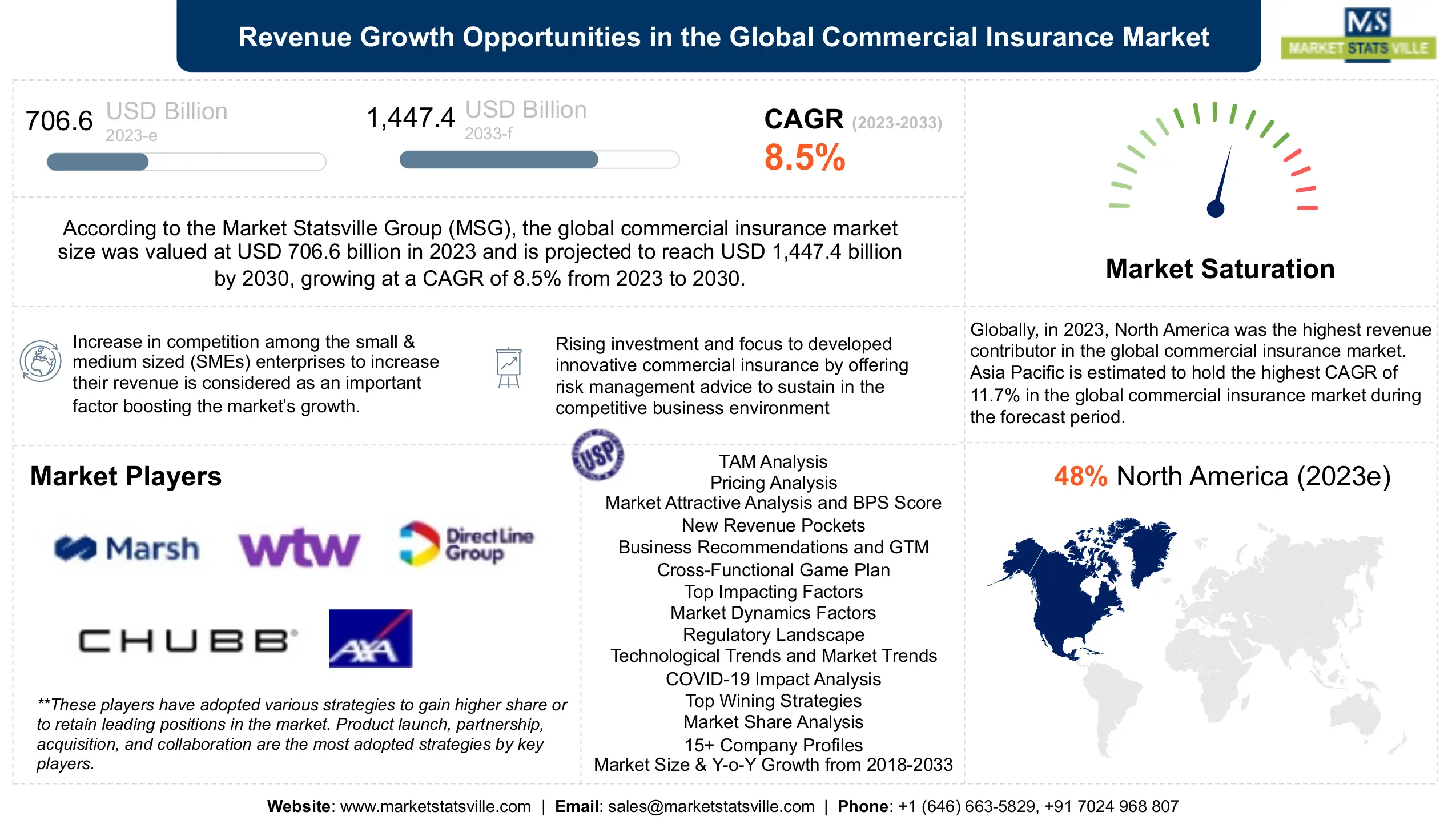

According to the Market Statsville Group (MSG), the global commercial insurance market size was valued at USD 694.6 billion in 2021 and is projected to reach USD 1,447.4 billion by 2030, growing at a CAGR of 8.5% from 2022 to 2030.

Increased competition among the commercial insurance providers to offer better services in terms of coverage and policies along with premium rates, the demand for commercial insurance has increased in the market. Also, business owners have a variety of policies from the number of commercial insurance providers to choose according to their needs & preferences. In addition, an increase in competition among small & medium sized businesses and an increase in the need for insurance policies among the enterprises to protect a business from pandemic scams are some of the factors propelling the market growth.

To know about the assumptions considered for the research report, Request a Free Sample Copy

A commercial insurance plan offers various types of insurance policies such as fire insurance, burglary insurance, liability insurance, business insurance, plant & machinery insurance, and others. Additionally, these insurance policies are specially designed to cover any type of risk associated with the business. Commercial insurance helps minimize the business's financial losses and promotes business continuity. It further protects the business image by managing risk and protecting the owners, customers, and shareholders associated with the business.

The unprecedented COVID-19 has drastically changed the company’s preference toward insurance. Business owners prefer to purchase insurance policies to cover specific risks and with limited premiums for business losses during the pandemic. In addition, with the surge in digitalization, business owners prefer to have personalized policies backed up by technology such as artificial intelligence, data analytics, and others.

Therefore, commercial insurance providers are adopting technology such as predictive analysis and artificial intelligence to offer insurers more customer-centric policies. For instance, with the help of artificial intelligence, insurance companies can improve the insurance underwriting process. Furthermore, artificial intelligence can also improve the claims cycle efficiently by accessing large amounts of data within a short time and reducing the chances of human error. Business owners can use the insurance agency’s AI-based system to report claims accurately. In addition, artificial intelligence further helps in data collection, leading to better risk identification and mitigation process, which makes claims processing easier.

In addition, smartphones and internet access has enabled companies to access policies through various applications. For instance, smartphones notify business owners via SMS on insurance coverage and remind companies of premium payments. As a result, these are major trends during the pandemic situation.

An increase in competition among the small & medium sized (SMEs) enterprises to increase their revenue is considered as an important factor boosting the growth of the commercial insurance market across the globe. The SMEs have been taking target-oriented decisions to improve their business performance. A commercial insurance policy helps to protect small businesses from injury claims and cyberattacks arising from advanced technology like telematics devices. Moreover, the major commercial insurance providers such as American International Group, Inc., AXA, and Aon plc have developed innovative commercial insurance by offering risk management advice to sustain in the competitive business environment, which drives the market's growth across the globe.

Commercial insurance companies have been developing high premium insurance products that are unaffordable to small businesses. This has negatively impacted the growth of the market. In addition, the premium of commercial insurance policy has been increased due to factors such as company location, employee size, business operations, and among others, which hinders the growth of the commercial insurance market.

The study categorizes the commercial insurance market based on type, distribution channel, enterprise size, industry vertical, and region.

On the basis of type, the commercial insurance market is segmented into commercial motor insurance, commercial property insurance, liability insurance, marine insurance, and others. In 2021, liability insurance had the largest market share of 30.1% in the global commercial insurance market. Commercial liability insurance is a commercial insurance policy that provides the business owner with protection against claims resulting from damages and injuries caused to a third-party business or property.

Hence, it safeguards the business from such accidents, for which the business might have to pay a huge amount to the third party to cover the loss or damage caused by the insured business owner. This is a major growth factor for commercial liability insurance. Furthermore, commercial liability insurance protects businesses from lawsuits, investigations, and legal settlements; if the damages are filed against the business owner or a third party sues the business owner for any reason.

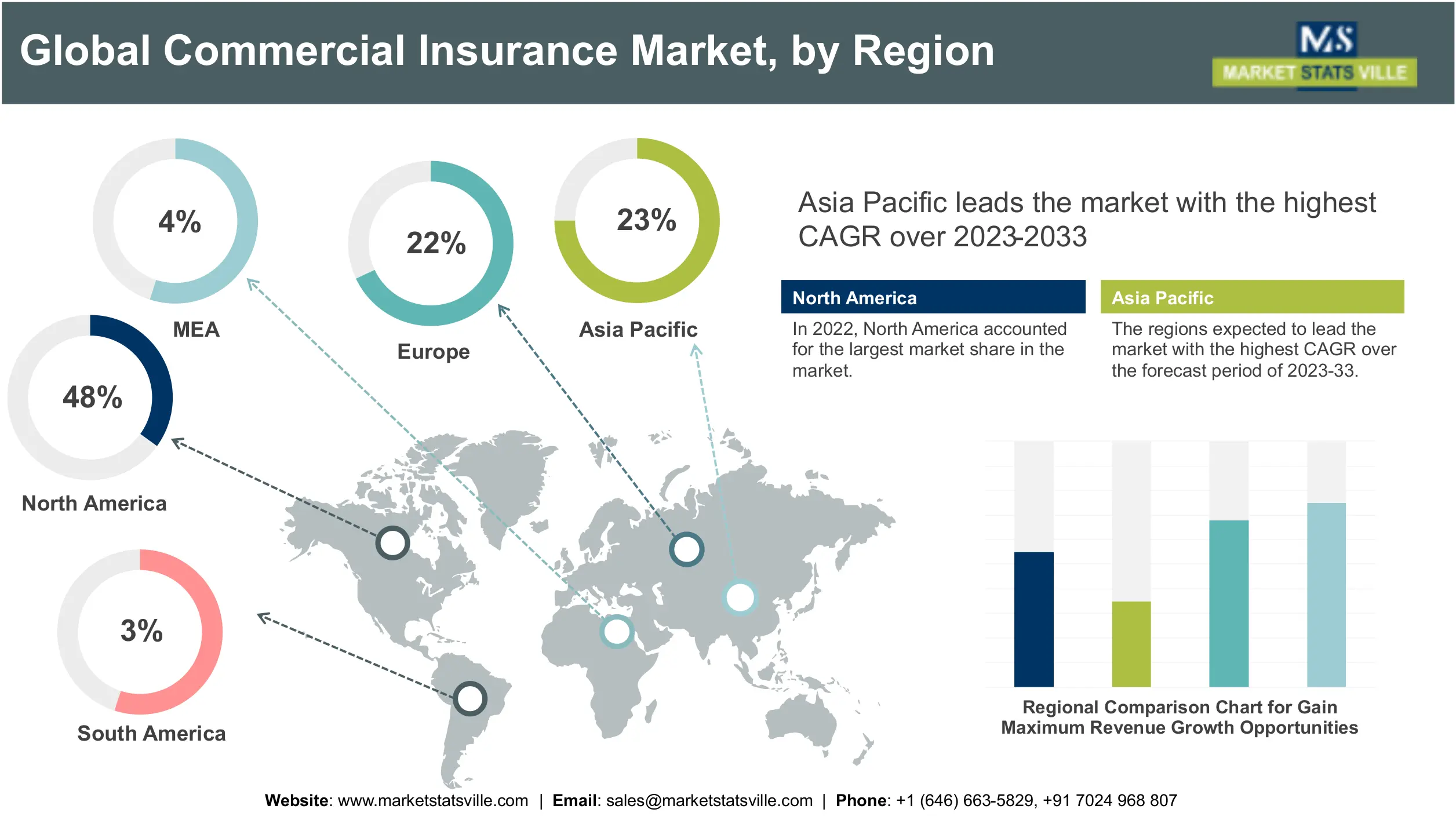

Based on the regions, the global commercial insurance market has been segmented across North America, Asia-Pacific, Europe, South America, and the Middle East & Africa. Globally, Asia Pacific is estimated to hold the highest CAGR of 11.7% in the global commercial insurance market during the forecast period. The countries studied in the Asia-Pacific commercial insurance market include China, India, Japan, Australia, South Korea, and rest of Asia-Pacific. Commercial insurance providers across China, India and Japan have been helping businesses to improve their annual performance and streamline their product operations which drives the growth of the market in this region.

Commercial insurance companies provide corporate organizations and board directors with several strategic risk advice, such as defining business objectives and establishing key performance indicators, which is considered as an important factor that boosts the growth of market in this region. In addition, commercial insurance helps business to reestablish corporate operations following natural disasters and extreme weather events, which fuels market growth. Furthermore, commercial business insurance helps an enterprise to protect its intellectual property, physical location, and financial asset from unforeseen incidences, which further cause huge financial losses.

The global commercial insurance market is consolidated in nature with a few players, such as Aon plc, Willis Towers Watson, and Marsh significant share of the market. These players have adopted various strategies to gain higher share or to retain leading positions in the market. Product launch, partnership, acquisition, and collaboration are the most adopted strategies by key players.

Report Attribute | Details |

Base Year of the Analysis | 2022 |

Study Period | 2018-2033 |

Forecast Period | 2023-2033 |

Region Covered | North America, Europe, Asia Pacific (APAC), South America, The Middle East and Africa (MEA) |

Countries Covered | US, China, India, Japan, Germany, the UK, France, Italy, Spain, Canada, Brazil, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Indonesia, Thailand, Malaysia, Vietnam, Australia and New Zealand, Argentina, UAE, Egypt, Northern Africa, and The Rest of MEA |

Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and market trends |

Free Customization Scope | 20% Free Customization |

Report Price and Purchase Option | Single User License: USD 3150 5-User Enterprise License: USD 4950 Corporate License: USD 7680 |

Customization Scope | Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional and segment scope. |

Post-Sale Analyst Support | 2 Months/60 Days |

Delivery Format | PDF and Excel on mail (We also provide the editable version of the report in Word/PPT format on special request with additional charges) |

Frequently Asked Questions

The global commercial insurance market size was USD 694.6 billion in 2021 and is expected to reach USD 1,447.4 billion by 2030.

The global commercial insurance market is projected to grow at a CAGR of 8.5% during the forecast period.

In 2021, Agents & Brokers had the largest market share of 63.5% in the global commercial insurance market.

North America had the largest market share in the global commercial insurance market. In 2021, region had a share of 45.6%.

Marsh, Direct Line Insurance Group plc, Willis Towers Watson, and Chubb are some major players in the market.

Want to Review Complete Market Research Report

Budget constraints? Get in touch with us for special pricing

Request for Special PricingCustomize this Report

Related Reports

Core Banking Market 2024: Industry Size, Emerging Trends, Regions, Growth Insights, Opportunities, and Forecast By 2033

Oct 2024Banking As-A-Service (BaaS) Market 2022: Industry Size, Emerging Trends, Region, Growth Insights, Opportunities, and Forecast By 2033

Mar 2024Europe Travel Insurance Market 2024: Industry Size, Emerging Trends, Regions, Growth Insights, Opportunities, and Forecast By 2033

Oct 2024Buy Now Pay Later (BNPL) Platform Market 2024: Industry Size, Emerging Trends, Regions, Growth Insights, Opportunities, and Forecast By 2033

Nov 2024Bancassurance Market 2025: Industry Size, Regions, Emerging Trends, Growth Insights, Opportunities, and Forecast By 2033

Mar 2024